us auto warranty insights for lasting value

Factory coverage ends; ownership keeps going. A well-matched plan cushions major repair swings, smooths cash flow, and preserves a car's utility for years. The goal is simple: spend less over the life of the vehicle while avoiding surprises. Not every driver needs it, but many benefit.

What coverage really means

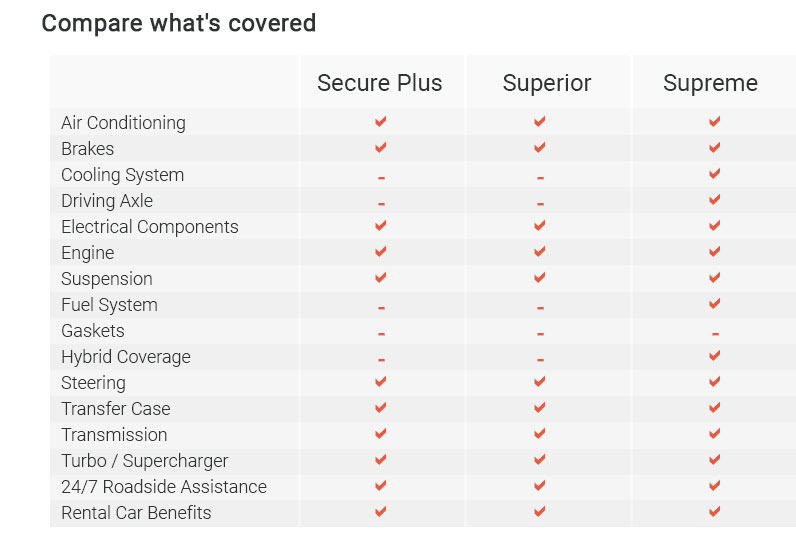

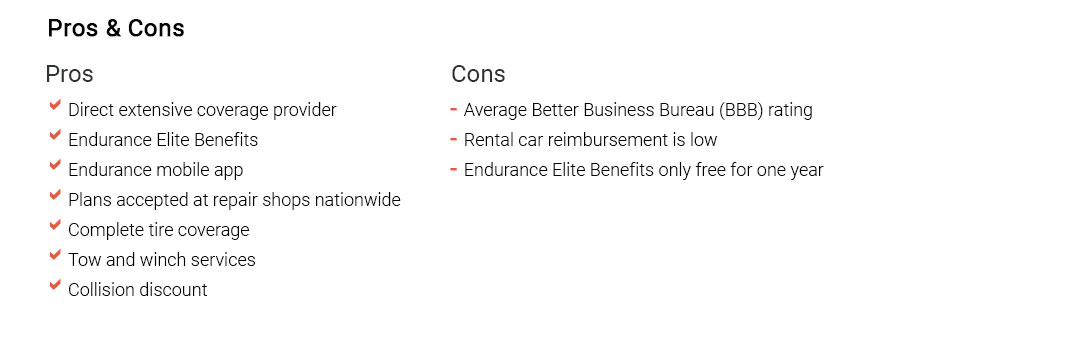

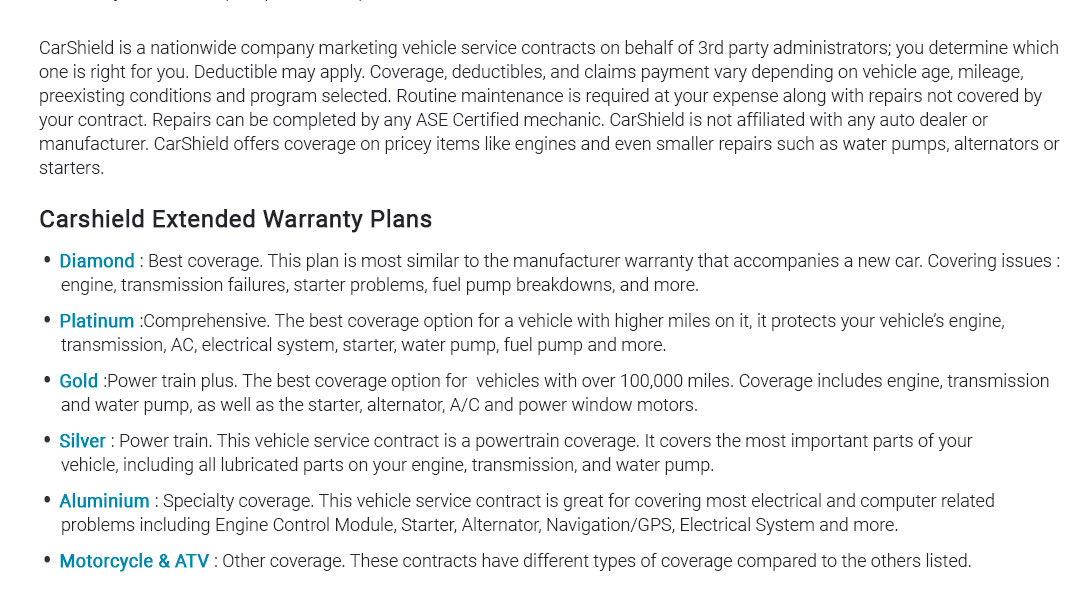

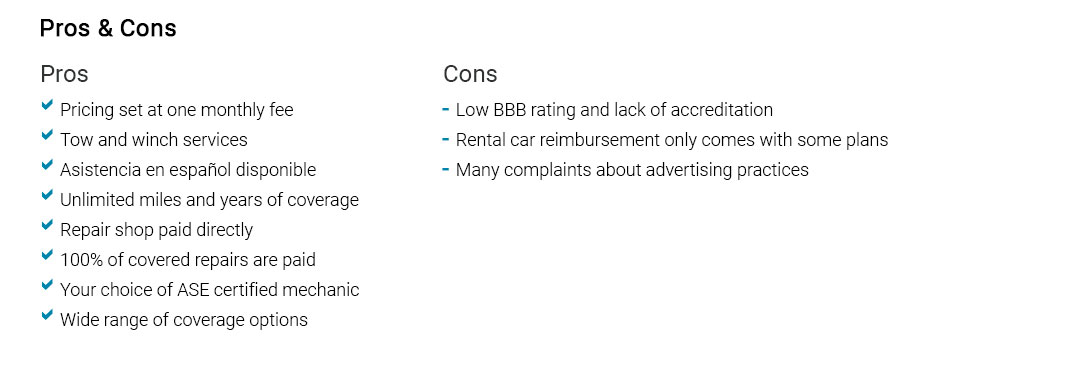

Policies vary widely. Focus on meaningful systems, transparent exclusions, and a claims path you can actually use. Costs matter; predictability matters more. Know who pays the shop, and how quickly. Consider cancellation terms and transferability; they influence resale.

- Powertrain: engine, transmission, drive components.

- Electronics: modules, sensors, infotainment - often pricey.

- Roadside: towing, jump-starts, lockout help.

- Rental reimbursement: keeps you mobile during repairs.

Real numbers, real days

Last winter in Ohio, Maya's alternator failed at 82,000 miles. Her plan covered towing and parts; she paid a $100 deductible, not the $980 shop estimate. The car was back by evening, no credit-card scramble. A moment - nothing dramatic - just a quiet look at totals.

How to evaluate offers

- Match term to your mileage horizon; avoid paying past the trade-in.

- Check deductible types: per visit vs per component.

- Read exclusions; wear items are usually out.

- Confirm repair network and OEM parts allowance.

- Ask how claims are authorized and paid.

Long-term strategy

Drive high miles? An exclusionary plan can cap big-ticket risks. Keep cars until 150k? Prioritize powertrain and electronics. Low annual miles? You may skip coverage and bank the premium.

Either way, think in total cost of ownership, not monthly line items. Savings compound when surprises don't. Budgets breathe easier. Future you will notice.